The Maldives is taking steps toward establishing a digital currency framework, as revealed by the Maldives Monetary Authority (MMA) and discussed at a recent Maldives National University (MNU) graduation event.

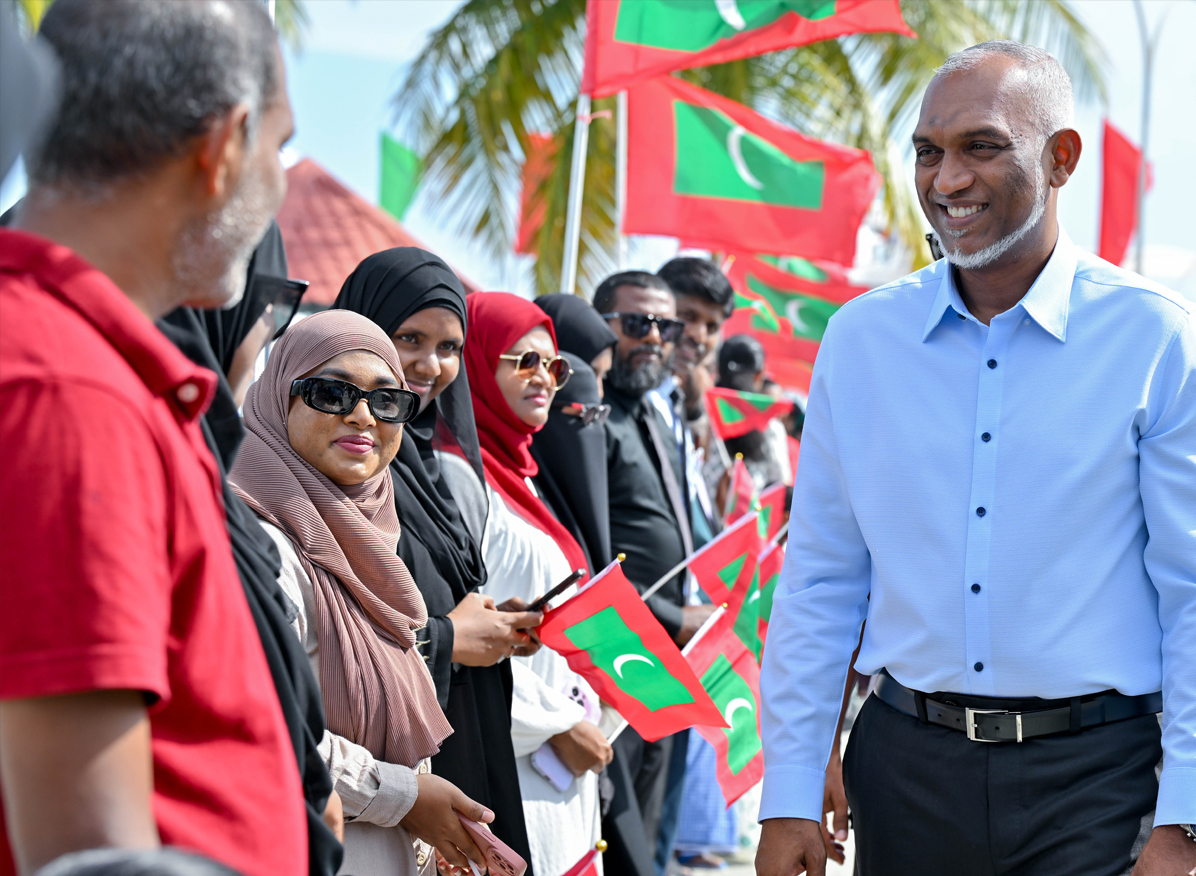

In alignment with the government’s vision for a digital economy contributing 15% of the GDP by 2030, President has directed the MMA to focus on digital currency legislation and explore possibilities for implementing cryptocurrency regulations.

Governor Ahmed Munawwar confirmed that work on this framework is already underway, aiming to adopt international best practices in digital finance.

The MMA has also been progressing with a national initiative to integrate more digital banking and payment systems into the financial landscape, like the recent Maldives Instant Payment System (Favara), which facilitates instant transactions among participating banks.

The introduction of digital currency is anticipated to enhance secure, stable payment solutions and potentially position the Maldives as a financial innovator in the region. By leveraging this technology, the Maldives intends to attract fintech investment, boost economic growth, and support local professionals and graduates as they enter the evolving digital finance sector